The largest pension plans have been using leverage and derivatives to manage asset liability risk for decades. Technology, experience, and increasing familiarity have brought the use of leverage and derivatives to the mainstream. Over the past 5 years, we’ve seen an increasing interest in these strategies from clients of all shapes and sizes for managing pension plan risk.

For pension plans that are beginning to explore the world of leverage and derivatives, this article will discuss:

- What is leverage, and what are derivatives?

- Why do pension plans use leverage?

- What are the common risk management strategies using leverage?

In a future article, we will try to answer:

- What are the main risks of using leverage?

- How can pension plans mitigate these risks?

- What should pension plans look for in an asset manager that will implement leverage or derivatives strategies?

What is leverage, and what are derivatives?

Leverage refers to having exposure to an asset class without fully owning the asset. This is achieved using either borrowed capital or financial instruments.

Derivatives are financial contracts that derive their value from an underlying financial asset. Pension plans can purchase these contracts to gain exposure to the underlying asset. For example, a pension plan that wants to gain interest rate exposure can purchase a contract to buy a bond at a fixed price in the future. By buying this contract, the pension plan gains exposure to the returns on the bond without purchasing the bond outright.

The terms leverage and derivatives are sometimes used interchangeably. However, not all leverage is achieved through the use of derivatives. For example, repurchase agreements allow a pension plan to use leverage. We will refer to the broader concept of leverage unless specific reference to the use of derivatives is appropriate.

Why do pension plans use leverage?

There are three common reasons.

1. Hedging asset liability risk - The most common reason we have seen pension plans use leverage is to manage asset liability risk. For example:

- Interest rate and inflation mismatch risk can be hedged using repurchase agreements and other interest rate derivatives; and

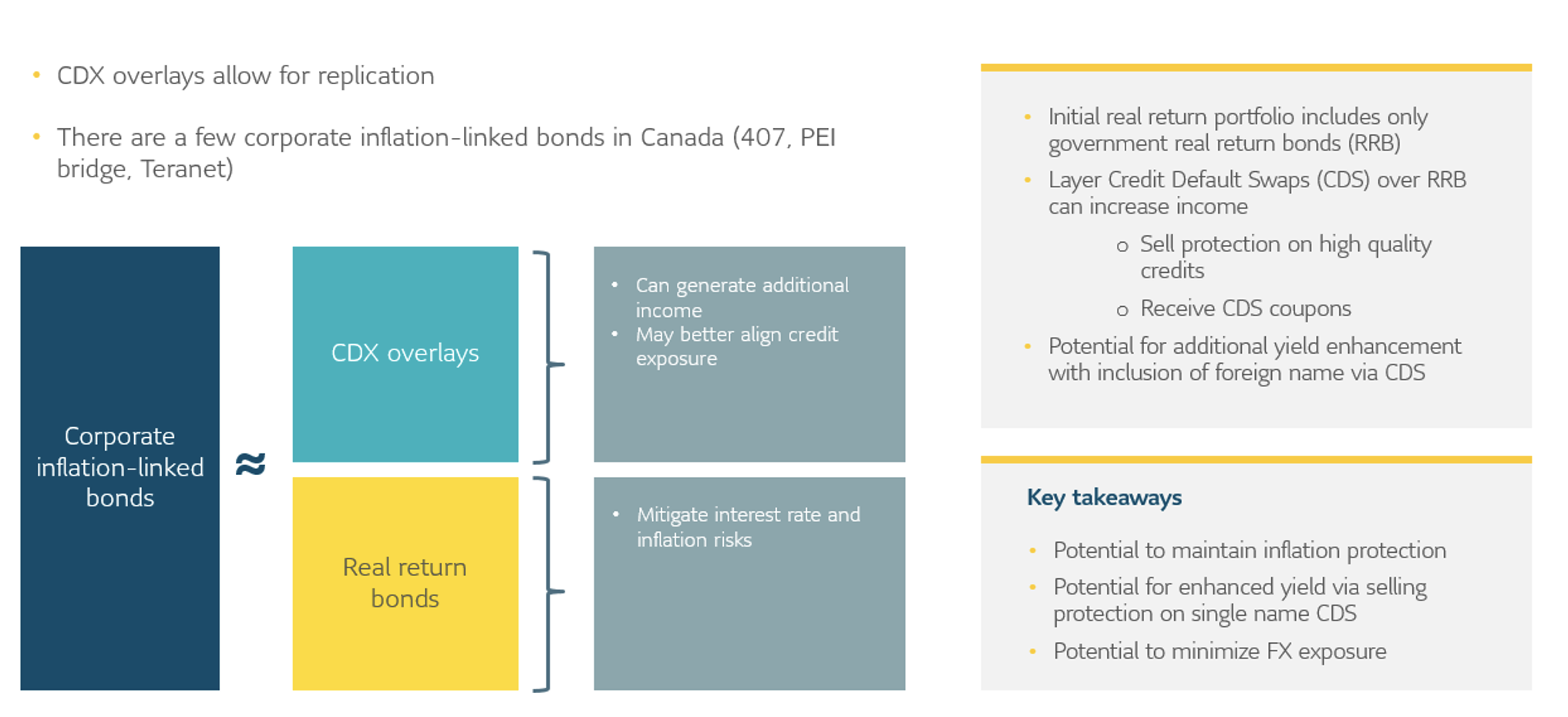

- Credit spread mismatch can be hedged with credit default or total return swaps.

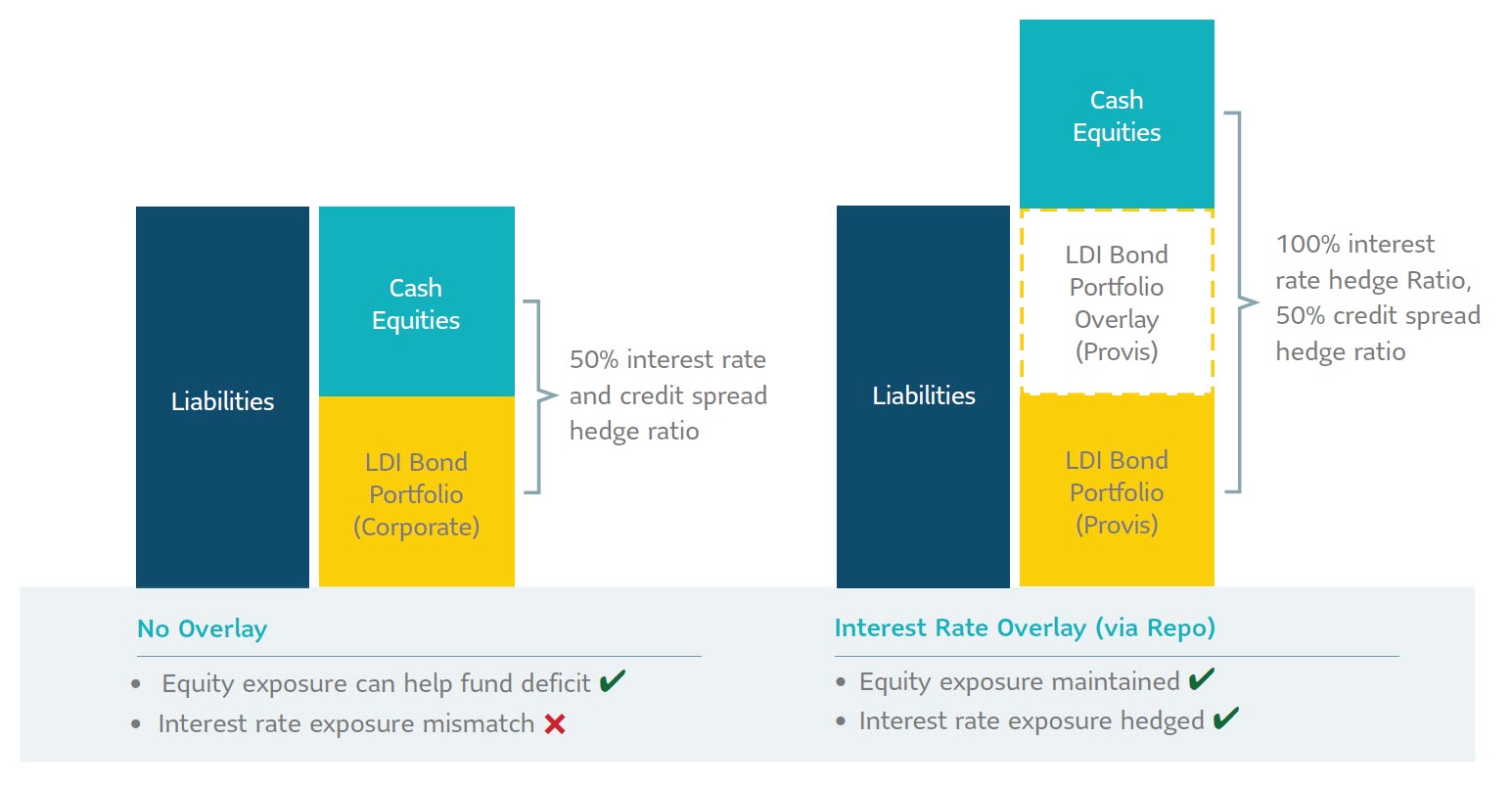

Underfunded plans can benefit from using leverage to manage asset liability risks while maintaining exposure to return-seeking assets to help fund their deficit. For example, equity futures and options can be used to maintain exposure to return seeking asset classes, while freeing up physical assets to be used to reduce asset liability risk.

2. Enhancing returns - Leverage can help pension plans:

- Increase exposure to return-seeking asset classes;

- Transfer alpha from one asset class to another; or

- Enhance return by investing in asset classes that are expected to earn more than the cost of borrowing.

In the fixed income world, return enhancing leverage is commonly used in private credit investments where managers will often offer a levered option to their funds. This allows plans to increase their exposure to these assets. The low interest rate environment of the last few decades has been favourable to these strategies.

3. Portfolio flexibility - Trading physical assets can sometimes be difficult or impractical due to transaction costs or liquidity challenges. In these cases, pension plans can quickly dial up or down their exposures using derivatives. The high liquidity of derivatives allows pension plans to quickly adjust their exposure, providing additional time to unwind physical assets, and saving on transaction costs.

In our experience, the most common use of derivatives for pension plans is for risk management.

What are the common risk management strategies using leverage for pension plans?

Pension plans typically use leverage to manage four types of asset liability risk: interest rate, inflation, currency, and equity.

Interest rate risk – Pension plan liabilities are exposed to changes interest rates. Unless the plan’s assets have a similar exposure, the plan’s funded status will also fluctuate due to changes in interest rates. Using leverage in an interest rate risk management strategy is a natural starting point for many pension plans and is the most common form of leverage we implement for our clients.