Watch now! Get an overview of the strategy from our investment team

After a slowdown in issuance that mirrored public markets during the first month of the global pandemic, investment grade private credit markets sprang back to life in late April and May. Investors were able to source attractive deals at significant yield premiums to similarly rated public bonds. Additionally, active managers continue to exploit market dislocations and generate strong risk-adjusted returns for clients by adding high-quality assets at historically compelling spread levels.

We believe there is a long-term role for both public and private fixed income in investors’ portfolios. Investment grade private credit complements public credit by adding additional spread premium and diversification while retaining a high correlation to long-term financial liabilities.

What is investment grade private credit?

Investment grade private credit¹ refers to loans and debt securities issued by companies or entities outside of the public capital markets. Investors are primarily institutions such as insurance companies and pension funds.

- Investment grade private credit instruments are similar to public debt. They typically have durations that range from five to 30 years, often include collateral and financial covenants and are available across the rating spectrum.

- Investors are paid a spread premium over comparable public bonds because these transactions are more customized and less liquid.

- The private placement issuer base includes public and private corporate issuers and spans major sectors (industrials, utilities, financials).

- Annual issuance in the investment grade private credit market is $70 to $100 billion per year and growing, with the U.S. representing about 60% of annual volume.2

Watch now! Get an overview of the strategy from our investment team

Over the last six years, SLC Management has averaged an 87 basis points yield advantage over comparable public bonds while experiencing lower downgrades and higher recoverables than the comparable public index. Year to date, the average yield advantage rose to 179 basis points, reflecting the attractive opportunity set available for investors.3

Investment grade private credit vs. public bonds and below investment grade private credit.

| Investment grade public corporate credit | Investment grade private credit | Below investment grade private credit | |

|---|---|---|---|

| Issuers/obligors | Large corporations | Companies, governments, non-profits | Mid-market companies |

| Use of proceeds | General corporate purposes | Project and asset specific | Leveraged buyouts |

| Income |

Fixed | Fixed | Floating |

| Rating | AAA-BBB | Typically A-BB, some AA | BB+ and below |

| Security | Unsecured | Secured and unsecured | Secured and unsecured |

| Ranking |

Can be subordinated | Senior | Senior and subordinate |

| Covenants |

Limited | Maintenance / comprehensive | Pressure due to increased competition among lenders |

| Tenor |

5, 7, 10, 30 years | Flexible 2-30 years | Typically 5 years |

| Liquidity | Liquid | Limited | Liquid |

| Historic spread to comparable public credit |

N/A | 10 - 100+ basis points | 50 - 400+ basis points |

| Annual issuance |

$1.2 - $1.3T | $70 - $100B | $200B+ |

Why investment grade private credit?

The strength, durability and growth of the investment grade private credit market reflects the wide range of benefits afforded to both issuers and investors.

Benefits to borrowers of investment grade private credit issuance:

Flexible terms

Features and deal terms of investment grade private credit can be highly customized to meet the needs of the issuer and include non-standard maturities, delayed or multiple draw periods and custom amortization.

Confidentiality

Issuers of investment grade private credit can bypass the time and expense associated with public disclosure and registration requirements, allowing private issuers to maintain confidentiality.

Knowledgeable investor base

Most investment grade private credit investors are affiliated with larger investment management organizations with dedicated analysts capable of underwriting unique or complex transactions that would be difficult to execute in the public market. Issuers also value the ongoing relationship with private investors as a source both of capital for growth and structuring expertise.

Benefits to investors of investment grade private credit markets:

Diversification

The investment grade private credit market offers investors the opportunity to invest in unique transactions and issuers not available to public bond investors.

Higher spreads

A combination of the illiquidity premium and bespoke nature of investment grade private credit placements relative to public bonds allow investors to capture a spread premium over comparable public issuers, as well as the potential for additional income associated with consents, amendments and, in some cases, coupon increases.

Better lender protections

Investment grade private credit investors benefit from deal structures that are typically more robust than public market transactions, including collateral and financial covenants that allow investors to get back to the negotiating table in the event of credit deterioration. Investors also benefit from direct access to management along with access to information not available to public investors.

Applications for Defined Benefit Plan Sponsors

Most plan sponsors are comfortable with the role private assets play within the growth-oriented portion of their portfolio, but typically we have seen less adoption within the liability-hedging portion. Hedging assets are typically focused on public corporate and treasury bonds, however as plan sponsors look for ways to add diversification and additional yield to their portfolios without taking on excess credit risk, investment grade private credit has become an attractive option.

Investment grade private credit complements traditional fixed income mandates in a well-rounded LDI program. Insurers have historically accessed this asset class to back long-term liabilities, and we believe a similar opportunity exists for plan sponsors to earn extra yield while still maintaining a strong correlation to plan liabilities.

Additional yield/diversification to keep pace with downgrade-immune liabilities

Pension plan liabilities are essentially “immune” to downgrades or defaults in the discount rate used to value them. This presents challenges for plan sponsors looking to construct fixed income portfolios that can keep pace and maintain funded status. Typically, plan sponsors have looked down the quality spectrum to increase potential returns and add diversification as they seek to build robust hedging portfolios. Investment grade private credit can provide additional yield without sacrificing quality.

Preparing for hibernation/termination

Investment grade private credit has been a staple of life insurers hedging strategies for long-term liabilities and the additional yield has contributed to attractive pricing for plan termination strategies. Plan sponsors can access these benefits directly through investing in similar strategies, while also building a portfolio that is attractive to life insurers should they decide to pursue a buyout in the future.

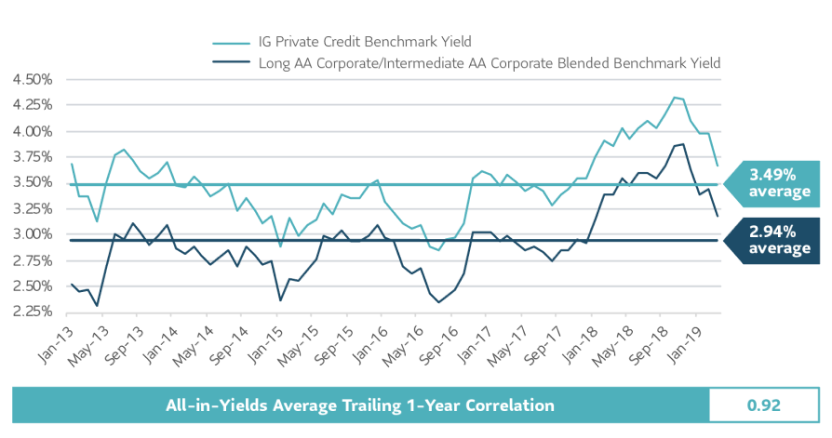

Correlation to liability discount rates

Investment grade private credit is an attractive asset class for plan sponsors looking to hedge high-quality liability discount rates. The correlation between investment grade private credit yields and AA-rated corporate bond yields reflects the high quality nature of the asset class and the joint dependence on underlying treasury yields. Typically, investment grade private credit yields provide greater stability in more volatile environments as they react more slowly to changes in the market.

All-in yields average trailing 1-year correlation

Notes: (1) The Long AA Corporate / Intermediate AA Corporate Blended Benchmark is 42% Bloomberg Barclays Long AA Corporate Index and 58% Bloomberg Barclays Intermediate AA Corporate Index. (2) IG Private credit benchmark represents Stonecastle spread data priced with same treasury basis as AA-corporate Blended Benchmark. Shown for illustrative purposes only. Source: Bloomberg and Stonecastle.

Applications for Defined Contribution Plan Sponsors

For defined contribution (DC) plan sponsors, investment grade private credit can provide an appealing middle ground between traditional corporate bonds and higher yielding “plus” sectors. With an increasing number of strategies available that fit within the DC regulatory framework, there are opportunities for plan sponsors to incorporate this attractive asset class into their portfolios.

Enhancing core plus mandates

Plan sponsors looking to add additional yield to their core or core plus portfolios can allocate assets from traditional public bond strategies towards investment grade private credit. Plan participants can benefit from the additional yield and lower losses relative to traditional investment grade public bonds, without sacrificing credit quality within their bond portfolios.

Increased portfolio diversification

Plan sponsors looking to enhance diversification and reduce volatility in their portfolios can utilize investment grade private credit alongside other “plus” sectors. Relative to these sectors, investment grade private credit exhibits much lower correlations to equities, high yield and emerging market debt. This is intuitive given the very different underlying risk factors that drive investment grade private credit versus these other asset classes. This added diversification benefit within a core plus mandate can provide protection for participants in times when equity markets are under greater stress.

| Primary Risk/ Return Factors | S&P 500 Total Return Index | MSCI All Country World Index ex USA | Bloomberg Barclays U.S. Corporate High Yield Total Return Index | Bloomberg Barclays Global High Yield Total Return Index | Bloomberg Barclays Emerging Markets Hard Currency Aggregate Index | |

|---|---|---|---|---|---|---|

| Investment Grade Private Credit | Private markets, Illiquidity Premium | 0.25 | 0.31 | 0.57 | 0.56 | 0.72 |

| Bloomberg Barclays U.S. Corporate High Yield Total Return Index | Credit & Equity Risks | 0.76 | 0.82 | 1.00 | 0.96 | 0.85 |

| Bloomberg Barclays Global High Yield Total Return Index | Credit, Equity & Currency Risks | 0.73 | 0.85 | 0.96 | 1.00 | 0.90 |

| Bloomberg Barclays Emerging Markets Hard Currency Aggregate Index | Credit, Equity & Currency Risks | 0.55 | 0.71 | 0.85 | 0.90 | 1.00 |

Source: Returns in the above monthly return correlation table are benchmark returns pulled from Bloomberg and Barclays Live from 1/31/2013 - 5/31/2020. Investment grade private credit returns are estimated and not based on actual performance data. Returns are estimated using monthly industrial private placement credit spread estimates (for 10 year A2 and Baa2 securities) sourced from StoneCastle Securities that generally reflect where the private IG credit market is pricing transactions. An investor may not invest directly in an index.

Accessibility through daily valued strategies

Daily valued investment grade private credit strategies allow plan sponsors to allocate to the asset class within their defined contribution plans. Typically, individual deals are valued on a monthly basis and then updated for daily market movements to fit within a daily valued DC framework. Similar to other core plus investment guidelines, limiting the allocation to 20% should ensure that the top-level bond fund or target date fund has sufficient liquidity on a daily basis while maintaining the benefits of the allocation.

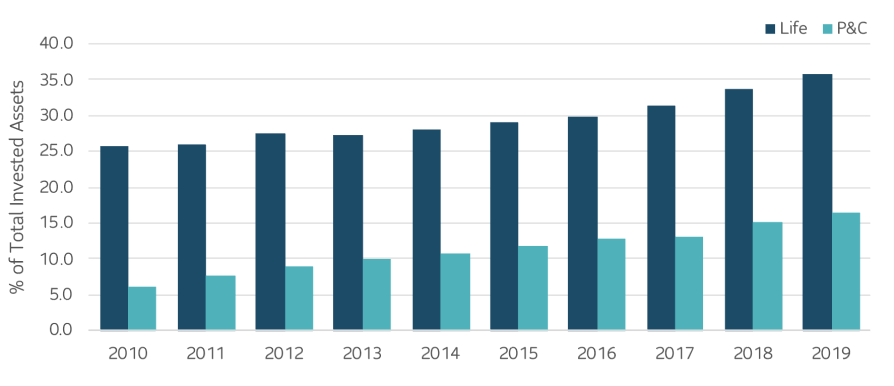

Applications for Insurance Companies

The attractive capital efficient yields have made investment grade private credit an integral component of life insurer’s portfolios, and in recent years, there has been significant adoption within the Property and Casualty (P&C) segment as well. P&C insurers look for ways to add yield without taking on additional credit risk or exposing themselves to regulatory charges, and investment grade private credit can effectively deliver these characteristics to the portfolio.

Capital framework treatment

Investment grade private credit is typically treated like any other fixed rate corporate debt security from an accounting and capital perspective. On a capital-adjusted basis, investment grade private credit presents insurers the opportunity to add attractive yield to their portfolios at a similar capital charge to traditional public debt.

Statutory and Regulatory Treatment

From a statutory filing perspective, investment grade private credit is disclosed on Schedule D Part 1 (Bonds) as an Amortized instrument, in line with traditional public debt. Similarly, the Risk Based Capital charges for investment grade private credit correspond to a NAIC 1 – 2 bond, depending on the rating.

Regulatory Modeling (AM Best BCAR, Moody’s, S&P)

About 80% of investment grade private credit deals have nationally recognized statistical rating organization (NRSRO) ratings, and the remaining balance is filed directly with the securities valuation office (SVO). In most cases, ratings agencies do not penalize investment grade private credit relative to traditional public fixed income. BCAR, Moody’s and S&P all treat investment grade private credit similarly to other fixed income securities that have a corresponding rating. However, Moody’s and S&P may apply a minor liquidity premium if they feel investment grade private credit allocations are excessive.

At SLC Management, we work with clients and consultants to manage liquidity concerns around private assets. Our investment process for insurers begins with a full review by our insurance solutions team. Stochastic modeling highlights areas of operational stress (reinsurance limits, CAT risk, and premium collection rates), measures the required portfolio liquidity and then assesses a client’s ability to harvest the illiquidity premiums available in private assets within a portion of their portfolio.

Historical allocation of private fixed income

Source: S&P Global Intelligence as of 12/31/2019. NAIC Industry Data as of 12/31/2019.

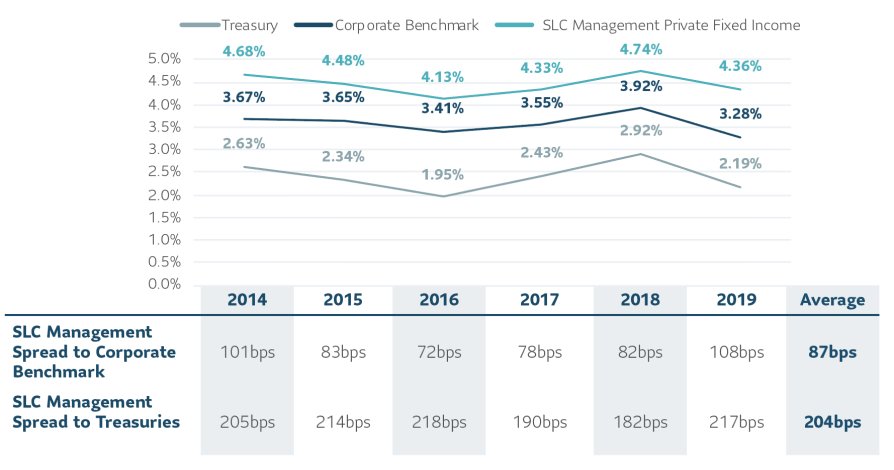

Investment track record

Investment grade private credit has historically provided higher yields than public bonds with comparable duration and ratings. In addition to higher yields, investment grade private credit has performed better than public bonds with respect to defaults and losses4. Restrictive terms and financial covenants allow investment grade private credit investors to identify and resolve credit issues before an actual default occurs.

SLC Management’s private credit team has generated an average annual spread premium, or relative value, of 87 basis points over the past six years. Our focus on niche sectors and transactions with structural complexity allow us to deliver attractive risk-adjusted returns for investors.

SLC Management’s average annual default rate has been 23bps since 2008 compared to 34bps for Moody’s equivalent benchmark. Additionally, our average annual loss rate was 6bps compared to Moody’s at 20bps.

Excess spread

Historical yields

Notes: (1) U.S. currency and fixed rate transactions. (2) Represent weighted average of the U.S. Private Fixed Income portfolio. See footnote 2 or disclosures at the end of the piece for a summary of the methodology used to estimate relative value to appropriate public benchmarks.

Investment grade private credit is a capital efficient asset class that can offer investors the potential for excess returns, lower downgrades and defaults and provide a natural hedge for long-term liabilities. SLC Management has a long history of active management in both public and private fixed income markets and is focused on adding consistent value for our clients.

1 Investment grade credit ratings of our private placements portfolio are based on a proprietary, internal credit rating methodology that was developed using both externally-purchased and internally developed models. This methodology is reviewed regularly. More details can be shared upon request. Although most U.S. dollar private placement investments have an external rating, for unrated deals, there is no guarantee that the same rating(s) would be assigned to portfolio asset(s) if they were independently rated by a major credit ratings organization.

2 Calculated internally based on external market data sourced from Private Placement Monitor and Bank of America Securities Private Placement Snapshot.

3 87 basis points over relative value is the 6 year average for private fixed income USD fixed rate deals. The relative value over public benchmarks estimate is derived by comparing each loan’s spread at funding with a corresponding public corporate bond benchmark based on credit rating. Loans that are internally rated as “AA” are compared to the Bloomberg Barclays U.S. Corporate Aa Index, loans rated “A” are compared to the Bloomberg Barclays U.S. Corporate A Index, while loans rated “BBB” are compared to the Bloomberg Barclays U.S. Corporate Baa Index. For certain power and utility project loans, a best fit approach of a variety of Bloomberg Barclays’ indices was employed prior to September 30, 2016. After this date, these types of loans were compared to Bloomberg Barclays Utilities A Index and Bloomberg Barclays Utilities Baa Index, for “A” and “BBB” internally rated loans, respectively. Relative spread values obtained through the above methodologies were then aggregated and asset-weighted (by year) to obtain the overall spread value indicated in the piece.

4 Source: NAIC (National Association of Insurance Commissioners), The Centre for Insurance Policy and Research, January 9, 2019.

This paper is intended for institutional investors only. The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. Registration as an investment adviser does not imply any level of skill or training.

There is no assurance that the objective of any private placement strategy can be achieved. The principal risks associated with the Advisor’s private placement strategies are described as follows. As with any strategy, the Advisor’s judgments about the relative value of securities selected for the portfolio can prove to be wrong.

(1) Interest rate risk involves the risk that interest rates will go up, or the expected spread to the benchmark will widen, causing the value of the portfolio’s fixed income securities to go down. This risk can be greater for securities with longer maturities and the widening of spreads can continue for an extended period of time. (2) Credit risk is the risk that the issuer of fixed income securities will fail to meet its payment obligations or become insolvent causing the market value of the securities to decrease. Private placements are not rated by the credit rating agencies. Any ratings assigned to this debt is the product of analysis performed by the Advisor and or Advisor’s affiliates. (3) Liquidity risk is the risk that Advisor may be unable to sell a given security at an advantageous time or price or to purchase the desired level of exposure for the portfolio. At times this market has experienced severe illiquidity and/or significant price impacts. (4) Counterparty risk involves the risk that the opposing party in a transaction does not fulfill its commitments.

Investment grade credit ratings of our private placements portfolio are based on a proprietary, internal credit rating methodology that was developed using both externally-purchased and internally developed models. This methodology is reviewed regularly. More details can be shared upon request. Although most U.S. dollar private placement investments have an external rating, for unrated deals, there is no guarantee that the same rating(s) would be assigned to portfolio asset(s) if they were independently rated by a major credit ratings organization.

The relative value over public benchmarks estimate is derived by comparing each loan’s spread at funding with a corresponding public corporate bond benchmark based on credit rating. Loans that are internally rated as “AA” are compared to the Bloomberg Barclays U.S. Corporate Aa Index, loans rated “A” are compared to the Bloomberg Barclays U.S. Corporate A Index, while loans rated “BBB” are compared to the Bloomberg Barclays U.S. Corporate Baa Index. For certain power and utility project loans, a best fit approach of a variety of Bloomberg Barclays’ indices was employed prior to September 30, 2016. After this date, these types of loans were compared to Bloomberg Barclays Utilities A Index and Bloomberg Barclays Utilities Baa Index, for “A” and “BBB” internally rated loans, respectively. Relative spread values obtained through the above methodologies were then aggregated and asset-weighted (by year) to obtain the overall spread value indicated in the piece.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of March 31, 2020. Unless otherwise noted, all references to “$” are in U.S. dollars.

Nothing in this paper should (i) be construed to cause any of the operations under SLC Management to be an investment advice fiduciary under the U.S. Employee Retirement Income Security Act of 1974, as amended, the U.S. Internal Revenue Code of 1986, as amended, or similar law, (ii) be considered individualized investment advice to plan assets based on the particular needs of a plan or (iii) serve as a primary basis for investment decisions with respect to plan assets.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

Past results are not necessarily indicative of future results.

© 2020, SLC Management