Originally published on U.S. based Pensions & Investments website on November 19, 2019.

Corporate pension plan sponsors, however, should view derivatives and the concept of leverage within a very different framework, beginning with the consideration that most pension plans are inherently leveraged due to sponsors' own investment choices.

Due to the discount rates used for calculating plan liabilities, pension plan liabilities exhibit similar interest rate sensitivities to a portfolio of corporate bonds. Therefore, the starting point for mitigating or hedging the risks associated with pension liabilities would typically be to invest the plan's assets in a portfolio of high-quality corporate bonds with a similar duration to the liabilities.

However, most plan sponsors will invest a portion of their plan assets in growth-oriented asset classes such as equities, a strategy that is part of nearly all liability-driven investing programs. This means dialing down the allocation to the hedging portfolio and reducing the degree to which the interest rate risks associated with the liabilities are mitigated. In return for taking on these risks, the plan sponsor hopes to benefit from the higher expected returns of the growth assets.

To look at this through a different lens, plan sponsors are taking on the corporate bond-like risks associated with their liabilities to fund an investment in riskier assets: put simply, they are adding leverage to their plans in the hope of achieving higher returns.

From this starting point, the challenge of reducing risk or lowering funded status volatility can also be viewed as a decision to try to deleverage the pension plan. In other words, plan sponsors need to find ways to replace the interest rate exposure they have lost in moving their portfolio away from being fully invested in high-quality corporate bonds.

Plan sponsors that wish to deleverage their plans, but also maintain the growth allocation of their portfolio, can increase the interest rate sensitivity of their assets by extending the duration of the fixed-income portion of their assets beyond the duration of the liabilities. This has the effect of making the fixed-income portfolio work harder to replace the assets that have been moved into other asset classes.

However, there is an limit to the amount of deleveraging that can be achieved by manipulating physical bond duration alone. Beyond a certain point, sponsors are constrained by the durations of the bonds available to them and by the physical assets they can deploy. Sponsors looking to de-risk further need to dial down their exposure to growth assets or find other ways to add the lost interest rate exposure back to the hedging portfolio.

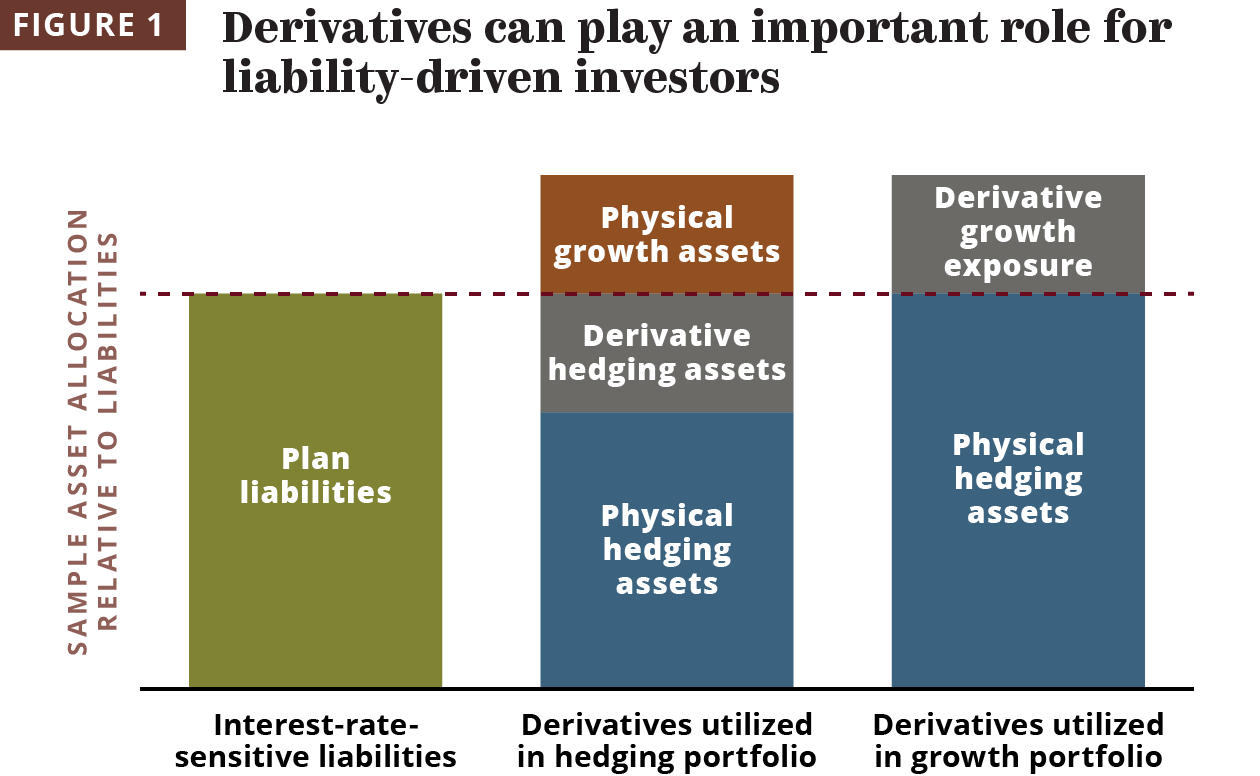

Using derivatives allows plans to separately hedge against interest rate risk, independent of the allocation decision between growth assets and hedging assets. Plan sponsors can maintain their allocation to the "rewarded" risks of growth assets while simultaneously deleveraging their plans from the "unrewarded" risks of being underhedged to interest rate risk.

By utilizing interest rate-based derivatives such as Treasury futures, or swaps, to synthetically replace the lost interest rate sensitivity of the plan assets, plan sponsors are able to enhance their hedging approach and further deleverage and de-risk their plan. This can lead to more stable and predictable funding and contribution outcomes.

Derivative solutions can be as simple as adding more duration to the hedging portfolio to make it work even harder than the physical bond portfolio alone. For later stage plans looking for a more nuanced approach, derivatives can be used to fine-tune the solution to target-specific liability or yield curve exposures.

Non-interest rate derivatives can also be used to achieve the same results. For instance, a second option for sponsors looking to reduce their interest rate exposure is to transfer physical assets into the liability-hedging portfolio and achieve the growth asset exposure through derivative products that synthetically replicate equity returns.

This approach achieves a similar liability hedging outcome but results in the plan sponsor owning a physical hedging portfolio and a synthetic growth portfolio rather than the other way around. Sponsors may have preferences for taking their physical exposure in the potentially less efficient fixed-income markets where there may be a greater opportunity for active management.

While derivative solutions can typically be implemented in straightforward and cost-efficient ways, many plan sponsors have historically avoided them within their LDI platform. Increasingly, however, we are seeing this trend shift as plan sponsors take a more holistic approach to hedging pension plan liabilities and look to utilize the full range of available tools.

While many investors think of derivatives as a tool to leverage returns, within an LDI context the opposite is typically true. Derivatives can be used as a deleveraging, risk-management tool that can form a crucial part of the LDI program for plan sponsors looking to reduce volatility within their pension plan, freeing up their risk budget to be better used throughout their business.

Timothy Boomer is head of client solutions at SLC Management.

The article was originally published on U.S. based Pensions & Investments website on November 19, 2019. The content of this article is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any of the content of this article. Nothing in this article should (i) be construed to cause any of the operations under SLC Management to be an investment advice fiduciary under the U.S. Employee Retirement Income Security Act of 1974, as amended, the U.S. Internal Revenue Code of 1986, as amended, or similar law, (ii) be considered individualized investment advice to plan assets based on the particular needs of a plan or (iii) serve as a primary basis for investment decisions with respect to plan assets.