2019 was a year defined by persistent trade tensions and the Federal Reserve’s abrupt pivot from hawkish to dovish. As progress on a U.S.-China trade deal initially floundered, global manufacturing slumped and central banks everywhere worried about a recession. Uncertainty hung over markets leading to spikes in volatility, but risky assets held up as investors continued to seek growth.

With global inflation contained, many central banks switched to cutting rates to avert a growth slowdown. And while quantitative easing essentially ended, some central banks capitulated and started expanding their balance sheets again. The European Central Bank (ECB) revived its asset buying program, the Fed began purchasing short Treasuries to normalize the repo market which was behaving erratically. And China not only cut rates, it also stimulated its economy through business and consumer tax cuts. All these efforts helped to ease financial conditions and bolster consumer confidence.

Meanwhile, business confidence remains gloomy, but it should get a boost as a U.S.-China phase one deal now seems to be buttoned down. The results of the trade negotiations were fairly predictable, with the U.S. dialing back some tariffs and China making transactional commitments. The thornier issues on industrial subsidies and cyber theft are still unresolved and left for phase two negotiations.

Nevertheless, against this backdrop most asset classes performed well. Central bank support was critical and helped arrest what could otherwise have been a nasty downturn.

Trade will define 2020

Key Trend: This year’s global sentiment will continue to be driven by trade tensions and other geopolitical risks.

While U.S.-China phase one negotiations seem to be resolved, this was always going to be the easy part as both leaders benefit from the deal - President Trump so that he can extol his deal making prowess ahead of the 2020 U.S. Presidential election, and President Jinping so he can offset some manufacturing weakness in China’s economy.

However, any ambitions for a quick phase two follow-on, have faded. The next stage of U.S. demands hit at the core of China’s prominent state run economic model. For now, the U.S. and China will continue to decouple. The drive for technology independence is forcing this and tension between the two nations’ governments will continue to percolate.

The other pressing issue is the tension between the U.S. and Iran. The recent death of Iran’s top military leader led to Iranian retaliation that avoided casualties. That allowed the U.S. to deescalate for now.

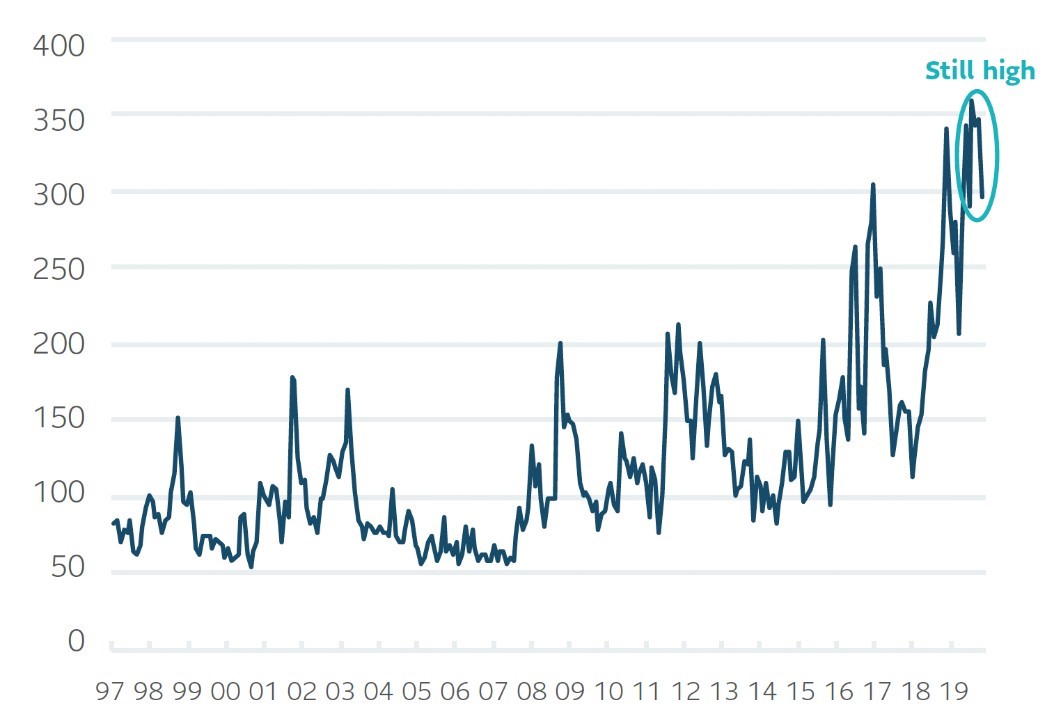

Global Economic Uncertainty Index

Source: PolicyUncertainty.com

However, the U.S. is not backing down on its demands that Iran abandon its nuclear program. It continues to tighten sanctions and as these reach a choke point, Iran could react by disrupting oil flow in the region to create a global economic shock.

If history is a guide, any bump in U.S. domestic support could quickly turn sour if overseas troop levels surge or higher oil prices lead to an economic shock. However, it is too soon to speculate on how provocative the standoff will be, but if it keeps escalating, risk sentiment could quickly cool.

Presidential election introduces new risks

Key Trend: The U.S. Presidential election in 2020 introduces a new risk that markets will need to evaluate.

A serious leadership challenge could heighten market volatility as investors evaluate any new policy direction. For example, the progressive crop of Democratic contenders plan to overhaul significant parts of the economy, including taxation, healthcare insurance, energy, and financial services. As this crowded Democratic field winnows down to a front runner, markets will start scoring the potential outcome more closely.

Trump’s approval rating is low, which makes him vulnerable to a Democratic contender. However, it has remained stable, and history suggests that as long as a President avoids a recession there is a high probability they keep their job. Therefore, deft economic stewardship will be Trump’s number one priority. If his approval ratings start to wilt, then markets will become more volatile as investors evaluate the Democratic candidate’s ability to disrupt the status quo.

Entering an election year with a split Congress, Trump has little room for domestic legislative success. He will likely demonstrate his leadership to an electorate through foreign policy initiatives instead. With trade in particular, the President has latitude and can aggressively weaponize tariffs to force results through a simple tweet. If Trump wants to showcase his anti-globalization agenda and fortify his approval ratings he can always grab headlines with a tariff threat. That may keep markets jumpy as he dials trade pressure up and down.

Key Trend: This year, global growth expects to see developed markets unchanged, while emerging markets perk up a little.

This modest pickup still leaves the global economy vulnerable to downside risk, which puts a high premium on the need for some trade cooperation.

What does it mean for markets?

2020 Outlook Summary: We believe that a global recession is unlikely in 2020. However, geopolitical risks will remain potent and inflation contained. We’ll see modest fiscal spending in developed markets and targeted fiscal spending in emerging markets that will help buoy markets. Equity returns will be driven by earnings growth and dividends. Wage gains will pressure profit margins.

During 2019, 70% of developed and emerging central banks eased monetary policy. This was the most synchronized easing since the Financial Crisis. This year, major central banks are expected to be on hold. In the case of the Fed, there is a high bar to enact any rate cuts and a very remote chance it hikes rates. The Fed would need to see growth struggling or inflation sinking to jump into action.

Treasury rates are expected to inch up this year as global growth improves. Meanwhile, corporate bonds should continue to perform well. Bond defaults are expected to be contained and low yields across the globe are creating demand for US corporate debt. While companies have, on average, taken on more debt since the Financial Crisis, low rates and strong cash flows allow them to ably service it.

Key Trend: The U.S. dollar will weaken.

US Dollar Index versus Major Currencies (2019)

Source: Bloomberg

As the lagged effects of fiscal expansion fade, US growth is slowing. That should lead to a weaker dollar, which would be a welcomed relief as it helps ease financial conditions for the rest of the world. There is also a silver lining for US exporters, making their output more competitive.

US equity returns in 2019 were mostly driven by Price/Earnings multiple expansion. Subsequently, equities now seem fully valued. Therefore, most of this year’s returns should come from earnings growth and dividends. Profits will feel the pinch of increasing wage costs, placing pressure on margins. Nevertheless, while the growth in earnings-per-share was negative in 2019, it is expected to increase this year. All in all, expect equity returns in the mid-to-high single digits.

Key Trend: Stocks should outperform treasury bonds.

Currently, the S&P 500 dividend yield exceeds the 10-year Treasury yield. Historically when this has happened, equities have outperformed bonds over the following year 94% of the time.

As noted already, investors will need to stay alert to U.S. Presidential election dynamics. The key factors that matter most to equities, other than a constructive central bank, are trade policy, taxes, regulation and the impact of government spending on certain sectors. As U.S. Presidential front-runners emerge it will be important to score their economic, trade and regulatory agendas.

2020 is gearing up to be a dynamic year with geopolitics, central bank policy and the U.S. Presidential election, all of which will impact the investment landscape on a global scale. Trade tensions will continue to dominate the geopolitical landscape, and every turn or tweet will likely impact market sentiment. Get ready for more volatility.

©2020, SLC Management

This material contains opinions of the author, but not necessarily those of Sun Life or its subsidiaries and/or affiliates. The content of this article is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any of the content of this article.