Unlike wars and natural disasters, pandemics do not typically require a surge of reconstruction, and they also tend to bring improved pay checks but lower returns for capital providers. Therefore, only by looking at past pandemics can we gain insight into the effects that COVID-19 may have on the global economy. As research shows, these effects can last for decades and have wide-ranging impacts on trade, wages and asset returns.

What Fifteen Pandemics Have Taught Us

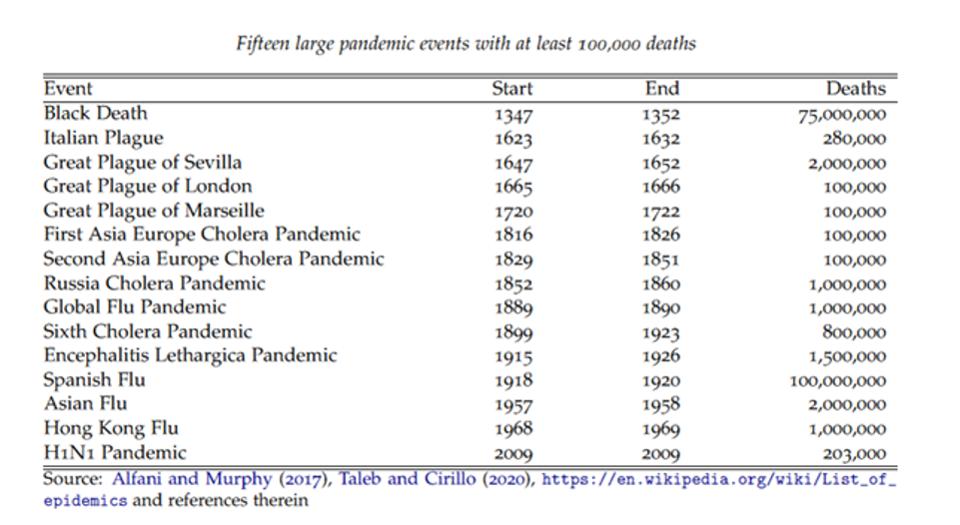

Researchers from the Federal Reserve Bank of San Francisco (FRBSF) and the University of California investigated the economic effects and impacts on asset classes of 15 pandemics from the 1300s to the present day that resulted in at least 100,000 deaths. They focused on Europe given its continuous data over centuries.

The deadliest pandemic over the last century was the Spanish flu, which infected one-third of the globe and killed between 50 and 100 million people from 1918 to 1920. Further back, the most devastating plague was the Black Death that ravaged Europe in the 14th century and killed 40% of its population.

List of Past Pandemics ALFANI AND MURPHY

While pandemics seem idiosyncratic and span over 700 years, the research found surprisingly consistent outcomes.

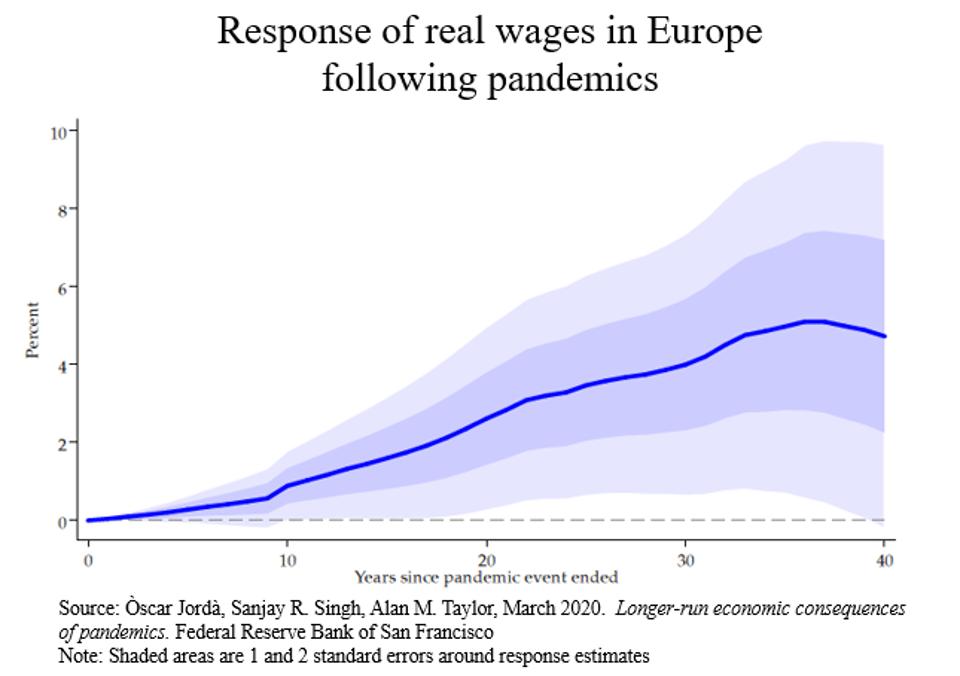

Wages Grow After Pandemics

The Black Death dramatically cut Europe’s agrarian workforce, resulting in more land than workers to farm it. Laborers’ bargaining power rose as did real wages, leading to a breakdown in the autocratic landlord system. Similarly, the Spanish flu also gave labor more bargaining power and raised real wages.

While these two pandemics were extreme, the FRBSF found similar results across all others: real wages increased post crisis over the subsequent four decades. On average, wages peaked at a cumulative gain of 5% over what would have occurred absent the pandemic. Results remained robust even when the Black Death and Spanish Flu were excluded.

Response of real wages in Europe following pandemics FEDERAL RESERVE BANK OF SAN FRANCISCO

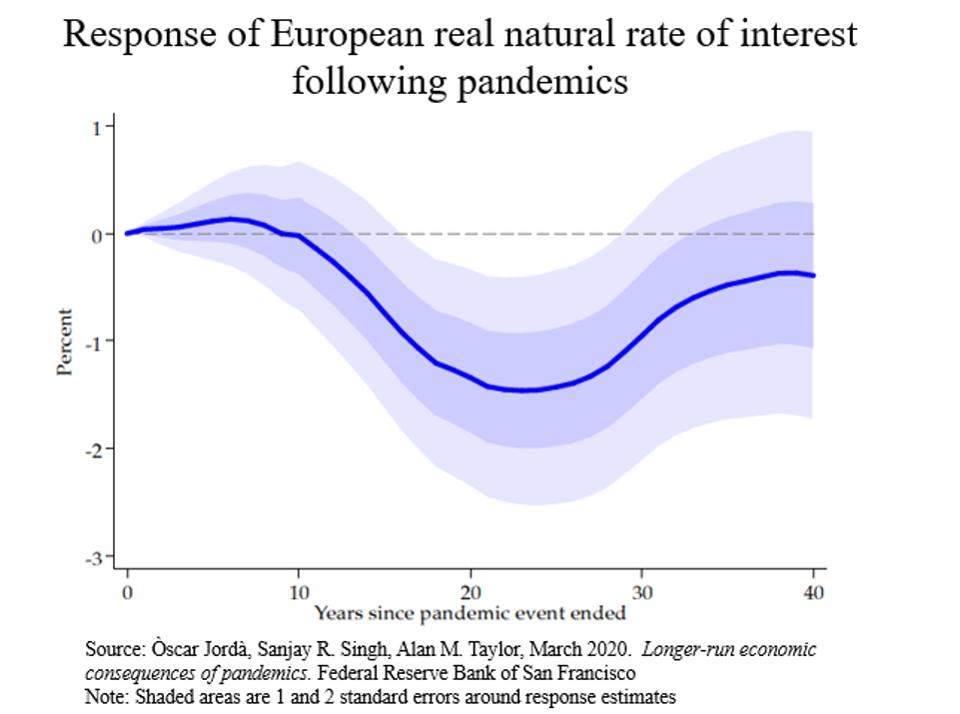

Real Rate Lows Last Decades

On the capital front, the FRBSF found that real rates dropped by as much as 1.5% versus that projected absent the pandemic. Real rates are a fundamental barometer of asset returns, controlled for inflation. High real rates reflect capital demand while low rates suggest caution.

Rates tended to hit the bottom after 25 years, but took over 40 years to recover to normally expected levels.

Response of European real natural rate of interest following pandemics FEDERAL RESERVE BANK OF SAN FRANCISCO

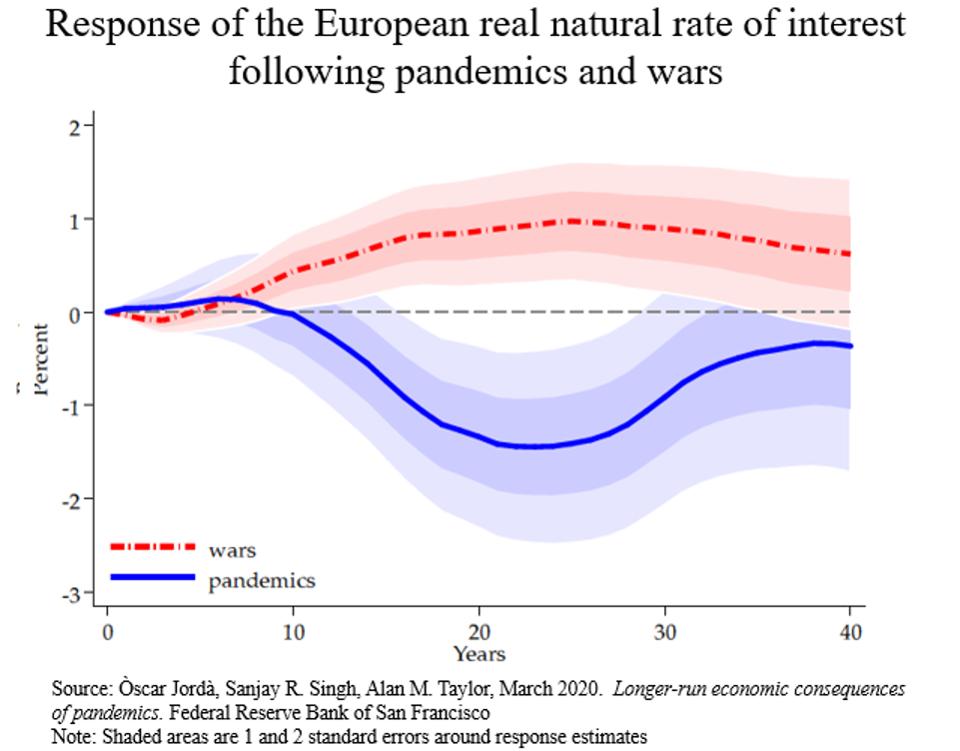

By comparison, post-war real rates were higher than otherwise expected, and given capital is needed for reconstruction, that is no surprise. But the persistency of higher rates over several succeeding decades was unexpected. It is as if the destitute of war breeds a sustained ambition to recover and excel. Germany, Japan and South Korea are prominent examples.

Response of the European real natural rate of interest following pandemics and wars FEDERAL RESERVE BANK OF SAN FRANCISCO

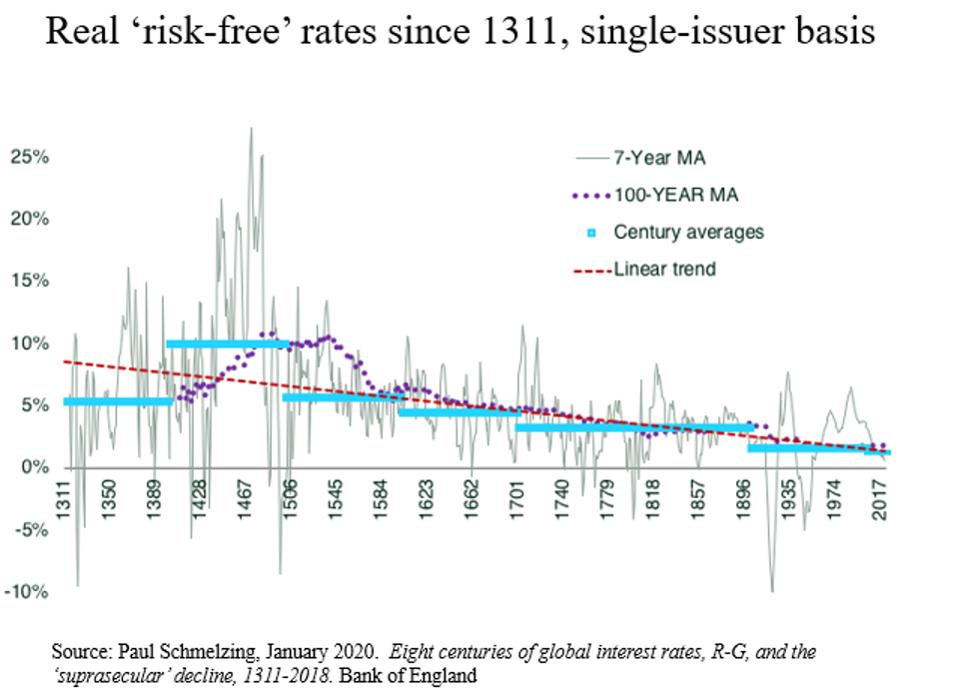

Other research also suggests low real rates are in the works for the foreseeable future. Paul Schmelzing at Yale University derived real rates from the sovereign debt of advanced economies from data back to the 1300s. He aggregated based on GDP to derive an indicative global sovereign real rate. The data series did not include any defaults.

Schmelzing’s results show real rates systematically dropping from close to 9% in the 1400s to under 1% over the past several years. While he leaves it to others to suggest the fundamental drivers of this decline, he did emphasize that the forces responsible seem impervious to monetary policies, political regimes or higher public debt.

Real "risk-free' rates since 1311, single-issuer basis BANK OF ENGLAND

Meanwhile, other researchers have hypothesized that once countries become more stable and the incidence of wars mitigates, the reduction in geopolitical risk tends to dampen real rates.

The End To The Current Era of Globalization?

The aftermath of many of Europe’s pandemics was also a reduction in trade. While trade links ushered in a higher standard of living pre-crisis, any related health scare usually led to a pullback. When the Spanish Flu ended so did the first era of industrial globalization that was already under siege from the tensions of World War I.

And so today, COVID-19 may bookend the apex of global supply chains developed over the last two decades with China at its hub. Prior to the virus, the U.S. was threatening tariffs on major trading partners to help reset relationships. Now that the virus has exposed potential supply vulnerabilities, it may accelerate reshoring – particularly for any production or process remotely related to national security.

The conclusion from history is that pandemics give a boost to real wages but deliver disappointing real returns. Unlike other catastrophes, such as wars or natural disasters, demand for capital doesn’t experience a surge after pandemics, which in turn results in an extended period of modest real rates.

It is reasonable to assume that the aftermath of this current pandemic will also keep real rates contained. This is likely to encourage investing beyond the traditional asset mix with more of a tilt to alternative assets with equity-like returns.

This article first appeared in Forbes. This material contains opinions of the author, but not necessarily those of Sun Life or its subsidiaries and/or affiliates.