Steve’s take: “Yields and pension plan funded statuses are at record highs, and short term expected overnight rate hikes are priced into the yield curve. As a result, this may be an opportune time for plan sponsors with remaining interest rate exposure to consider de-risking.”

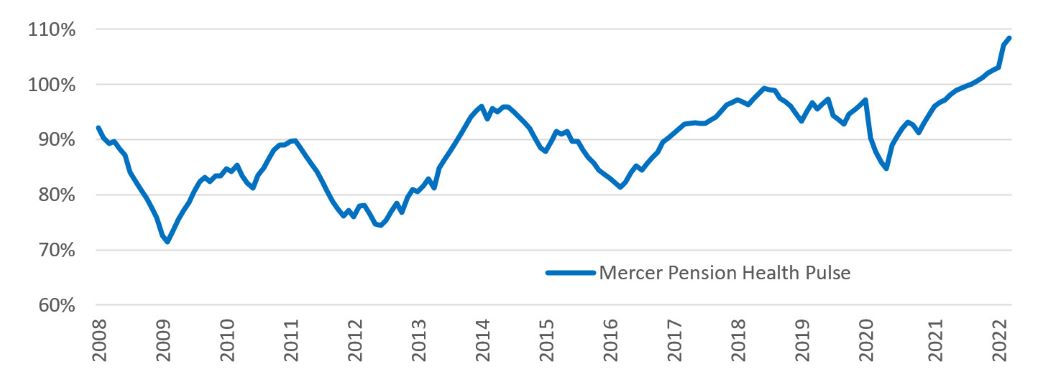

Solvency funded status levels are at a 14-year high

- The Mercer Pension Health Pulse (chart 1) increased from 103% at 12/31/2021 to a record-high 108% at 3/31/2022. This measure tracks the median solvency ratio of the DB pension plans in Mercer’s pension database. This trend is consistent with indices issued by other major consulting firms.

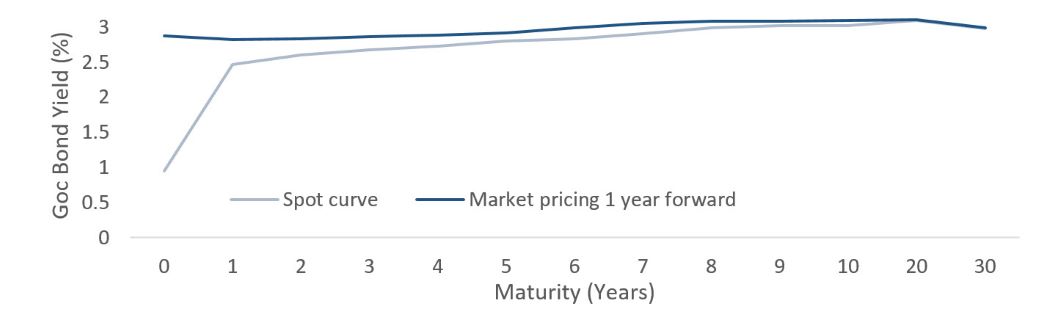

Expected overnight rate hikes are priced into the yield curve

- Markets expect 1.96% in rate hikes, which would bring the overnight rate to 2.96%.

- The 1-year forward curve is quite close to the current spot curve (chart 2). This suggests the market expects little change in the yield curve.

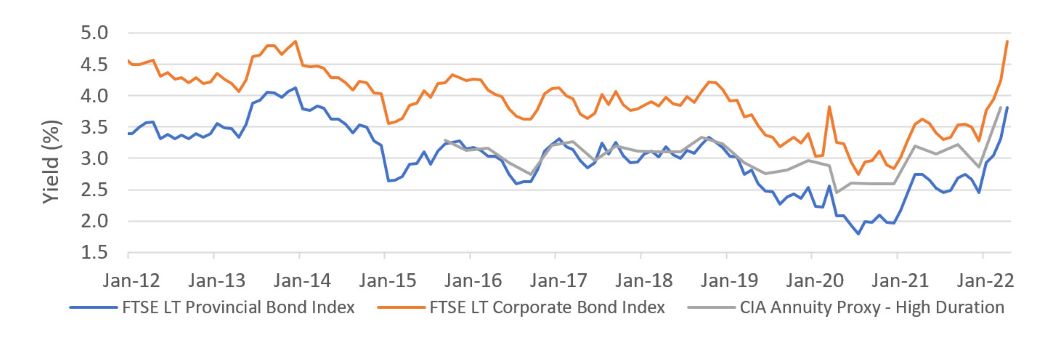

Long corporate bond yields are at an 11-year high

- Long corporate bond yields currently provide a very attractive yield compared to historical data (chart 3).

- Because corporate bond yields track closely with changes in the CIA Accounting Curve and the CIA Annuity Proxy, this 11-year high presents a great entry point for plan sponsors looking to better hedge solvency and accounting liabilities.

Chart 1: Mercer Pension Health Pulse

Source: Mercer

Chart 2: Spot curve vs. market pricing 1 year forward

Source: Bloomberg

Chart 3: Long term yields

Source: FTSE and CIA

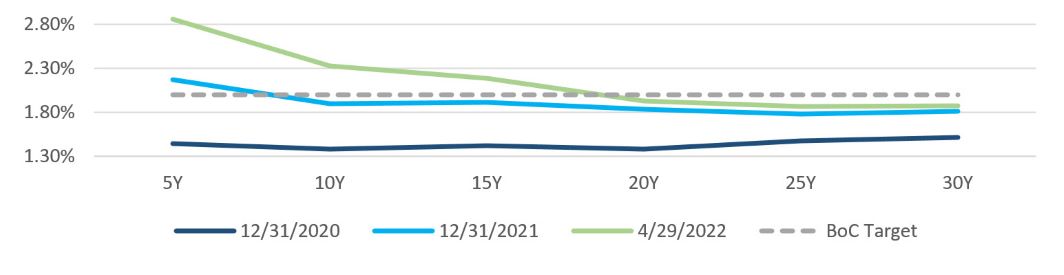

Long-term break-even inflation rates remain relatively low compared to the BoC policy rate

- While short- and mid-term break-even rates (chart 4) have risen meaningfully, long-term break-even rates remain below the Bank of Canada policy rate of 2%.

- This presents a great entry point for plan sponsors who want to protect their plans from further inflation surprises or an increased BoC policy rate.

- Examples of inflation protection strategies include purchasing real return bonds or overlaying break-even inflation protection on an existing fixed income portfolio using repurchase agreements.

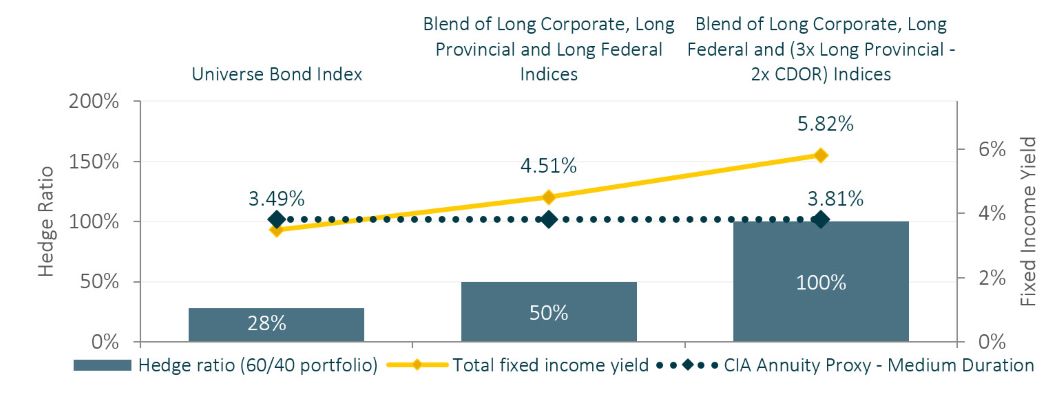

A blend of long corporate, provincial and federal market indices may provide a 102 bps pickup in fixed income yield vs. the universe bond index

- Market-based benchmarks with increased allocations to credit and leveraged exposure to provincial bonds may allow plan sponsors to target higher yields while improving liability hedge ratios (Chart 5).

- These benchmarks may help a plan sponsor target a higher yield than the current solvency discount rate**

Unless otherwise stated, all data as at April 29, 2022

** Assuming solvency liability is 100% annuity purchase

Chart 4: Break-even inflation curve (%)

Source: Bloomberg

Chart 5: Yields and hedge ratios of various market index blends (illustrative)

Source: SLC Management. For Illustrative Purposes Only.

Why SLC for LDI solutions?

- SLC Management offers a broad LDI toolkit spanning across traditional and alternative asset classes, designed to create solutions tailored to individual client objectives.

- We have a long history of outperforming liability-based benchmarks. Details on the performance of our SLC Management LDI composite GIPS Report are available upon request.

FOR MORE INFORMATION: SLC.info@sunlife.com

The content of this presentation is intended for institutional investors only. It is not for retail use or distribution to individual investors. All investments involve risk including the possible loss of capital. This presentation is for informational and educational purposes only. Past performance is not a guarantee of future results.

Unless otherwise stated, all figures and estimates provided have been sourced from the Bank of Canada. The information provided on liquidity is based on internal investment management experience. Unless otherwise noted, all references to “$” are in CAD. Any reference to a specific asset does not constitute a recommendation to buy, sell or hold or directly invest in it. It should not be assumed that the recommendations made in the future will be profitable or will equal the results of the assets discussed in this document.

The information contained in this presentation is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this presentation.

Forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. Do not place undue reliance upon such forward-looking statements.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (Canada) Inc. operates in Canada. More information are available at https://www.slcmanagement.com

Mercer Pension Health Pulse (chart 1)

Sourced from Mercer

Spot curve vs. market pricing 1 year forward (chart 2)

Sourced from Bloomberg

Long term yields (chart 3)

Provincial and Corporate Long Term Bond yields sourced from FTSE

CIA Annuity Proxy is equivalent to [CANSIM V39062 sourced from Bank of Canada] + [AP Spread for High Duration plan, published by the Canadian Institute of Actuaries]

Break-even inflation curve (%) (chart 4)

Sourced from Bloomberg

Yields and hedge ratios of market index blends (chart 5)

Based on data sourced from FTSE. Market index blends used available on request.

Hedge ratio calculated assuming a 60% allocation to return seeking assets and a 40% allocation to the indicated fixed income benchmark, assuming liability duration matches the medium duration plan in the CIA Annuity Proxy

“FTSE®” is a trade mark of FTSE® International Limited and is used under license.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© SLC Management, 2022