Market

The U.S. Private Placement market had a strong start to the year with Q1‘22 market volume of $24.4 billion, significantly ahead of Q1’21 issuance of $17.9 billion. While January was strong, the quarter closed with a flourish of deals, March 2022 volume handily surpassed January and February. Buoyed by a strong economy, the market shrugged off, at least for now, geopolitical tensions, inflation, and rising Treasury rates, which is in line with the market’s reputation of willingness to underwrite through uncertainty.

Cross border volume of 33% of total issuance was up from 28% in Q1’21 for a number of reasons. These include the tapering of local government stimulus, a return to more normal swap rates as the markets have recovered from Covid, and strong execution by the U.S. Private Placement market offering better execution as European markets became more volatile with the onset of the war in Ukraine.

The financial sector comprised 66% of total issuance in the quarter, up from 58% a year ago and from 23% in Q1’19. Issuance in the sector is split fairly evenly between Investment Firms (asset managers, funds and finance companies) and REITs and real estate transactions. In particular, the market for alternative asset managers has been mixed. There has been a wide distribution of manager quality, size, and structural protections. The market is struggling to digest the volume in this sector, which benefits investors with specialists in this field who can pick strong credits that still have good relative value.

Private spreads were stable to start the year and widened across tenors and credit quality in February due to the war in Ukraine. While the public bond market spreads widened quickly, private credit market spreads were slow to move out and we saw relative value squeezed for a few weeks in late February and early March. Public market and private market spreads tightened in March. Reportedly a few deals were postponed due to market volatility, but in general our market operated well and was a steady and reliable source of funding throughout the quarter. Deal oversubscriptions and fractional allocations in the broadly distributed market continue as investor demand for private credit exceeds supply. We expect this to persist as our market attracts more investors due to strong covenants and structures and compelling relative value.

SLC Management

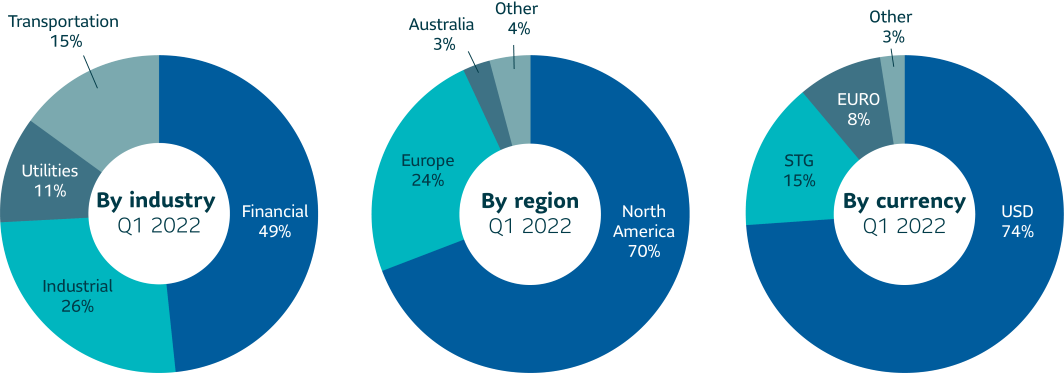

SLC Management’s USD fixed rate activity for Q1’ 22 was selective with $623 million across 16 transactions. The investment mix reflected a healthy mix of well-priced broadly marketed transactions and higher value club/proprietary transactions. SLC Management transactions averaged an 8-year weighted average life, an average UST equivalent spread of 202 bps. In terms of quality, the mix between A and BBB for the quarter was 43% and 57%, respectively.

Outlook

Market volatility makes for interesting markets, but we remain hyper-focused on achieving our relative value targets. As public spreads widen, we will likely have fewer opportunities as the private market responds slowly. However, this market will provide unique opportunities to investors that are willing to do heavy underwriting. We expect to see attractive opportunities in sectors such as asset managers and infrastructure. We continue to see value in less competitive, bespoke transactions where we can leverage our strong origination platform, sector expertise and longstanding relationships to maximize allocations.

| Q1 2022 | Weighted average life | Average rating | Average Spread¹ |

|---|---|---|---|

| Private Placement market | 10.2 years | 43%: A 57%: BBB |

137 |

| SLC Management² | 8.4 years | 43%: A 57%: BBB |

202 |

¹ All commitments

² SLC Management figures based on all commitments

Investment grade credit ratings of our private placement’s portfolio are based on a proprietary, internal credit rating methodology that was developed using both externally purchased and internally developed models. This methodology is reviewed regularly. More details can be shared upon request. Although most U.S. dollar private placement investments have an external rating, for unrated deals, there is no guarantee that the same rating(s) would be assigned to portfolio asset(s) if they were independently rated by a major credit ratings organization.

In focus: Private market behaviour in volatile public markets

The first quarter of 2022 saw extreme volatility in public fixed income markets. The Fed pushed to strike a hawkish tone due to levels of inflation not seen since the 70s and commodity markets reacted to the Russian invasion of Ukraine. We saw regular double-digit basis points moves in Treasury yields, as well as aggressive flattening of the yield curve. However, amidst this surging volatility, private credit market issuance has remained steady due to the unique supply/demand dynamics of the market.

Private issuance can be less reactive to current events

The Investment Grade Private Credit (IGPC) market has a reputation as a consistent source of capital in turbulent markets. Historically, the market has been dominated by U.S. life insurance companies, which continue to receive insurance premiums throughout market cycles and have a need to put the money to work in all market conditions.

Deals in the IGPC market have substantially longer marketing periods, ranging from two weeks to six months or more, depending on the level of complexity and specialization. For broadly syndicated deals, the price talk is typically released at least a week before the bid dates, and investors seem to mentally anchor around those numbers, despite movement in the public markets between the release of price talk and the bid date. For many transactions, investors in the market seem unwilling to walk away from the underwriting work that has been done despite lower relative value due to movement in public spreads, particularly for club or bilateral transactions that take months to put together. Part of this is due to the inability to get access to the credit except at the new issuance point, as the majority of investors are buy-and-hold and secondary trades are frequently unavailable to purchasers. For an opportunity to purchase bonds from a new issuer in the market (or one that has not come to the market for a long time), the value of diversification and the covenants can outweigh relative value concerns in some situations for some investors.

Wait or proceed?

Issuers have responded to rising rates and volatility in different ways. For traditional corporates, the practice of issuing bonds just to have excess liquidity is over as the cost of holding those funds is now higher. However, for issuers that have capital needs in the next twelve months, issuance now ahead of the potential for rising rates is attractive. For financial companies that are sensitive to the cost of capital, such as lessors and REITs, the higher yields are tough to swallow. These issuers seem to be more cautious about issuance, waiting until they can purchase new assets at levels that make the debt attractive. This is not the case for alternative asset managers, who benefit from asset returns that are multiples of the cost of senior debt. For single project deals, the current market can be challenging. These include project finance deals such as wind and solar farms and credit tenant leases. These deals frequently take years for developers and sponsors to put together. In some cases, the economics of the lease or off-take agreement was agreed some time ago. The rise in rates, combined with higher construction costs due to supply chain issues and inflation, is making some of these projects uneconomic for the sponsor. We have seen deals cancelled or some issuers turning to the bank market for five-year financing. It will be interesting to see what the interest rate environment looks like in five years when those deals mature.

Summary

Despite public market volatility, issuance, and demand in IGPC has remained strong. Parties are less likely to withdraw from the market due to the repeat nature of transactions, and attractive yields and capital treatment allow the investor base to continue to find the market attractive. At SLC Management, we believe that volatility tends to breed opportunities for managers who have the resources and expertise to be selective in this space and we continue to look for attractive issues and sectors on behalf of our clients.

Data presented in this article has been calculated internally based on external market data sourced from Private Placement Monitor.

Investment grade credit ratings of our private placement’s portfolio are based on a proprietary, internal credit rating methodology that was developed using both externally purchased and internally developed models. This methodology is reviewed regularly. More details can be shared upon request. Although most U.S. dollar private placement investments have an external rating, for unrated deals, there is no guarantee that the same rating(s) would be assigned to portfolio asset(s) if they were independently rated by a major credit ratings organization.

The information in this paper is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this paper.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (U.S.) LLC in the United States, and Sun Life Capital Management (Canada) Inc. in Canada operate. Sun Life Capital Management (Canada) Inc. is a Canadian registered portfolio manager, investment fund manager, exempt market dealer and in Ontario, a commodity trading manager. Sun Life Capital Management (U.S.) LLC is registered with the U.S. Securities and Exchange Commission as an investment adviser and is also a Commodity Trading Advisor and Commodity Pool Operator registered with the Commodity Futures Trading Commission under the Commodity Exchange Act and Members of the National Futures Association. Registration as an investment adviser does not imply any level of skill or training. There is no assurance that the objective of any private placement strategy can be achieved. As with any strategy, the Advisor’s judgments about the relative value of securities selected for the portfolio can prove to be wrong.

Unless otherwise stated, all figures and estimates provided have been sourced internally and are as of March 31, 2022. Unless otherwise noted, all references to “$” are in U.S. dollars.

This document may present materials or statements which reflect expectations or forecasts of future events. Such forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. As such, do not place undue reliance upon such forward-looking statements. All opinions and commentary are subject to change without notice and are provided in good faith without legal responsibility. Unless otherwise stated, all figures and estimates provided have been sourced internally and are current as at the date of the paper unless separately stated. All data is subject to change.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© 2022, SLC Management