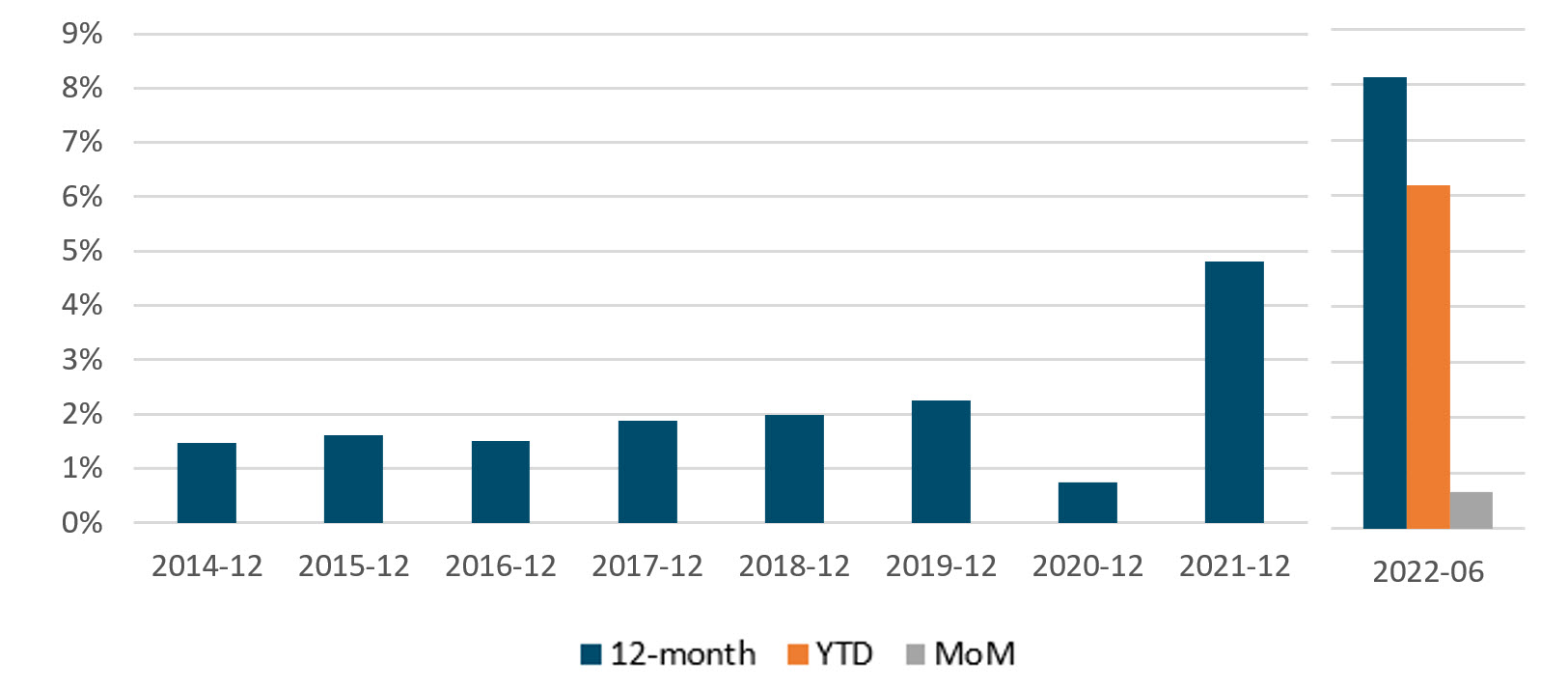

Steve’s take: “Despite small signs of improvement, inflation remains elevated and widespread in Canada. As of June, Canadian headline CPI was up 8.1% year-over-year and 0.7% month-over-month (chart 1). While this paints a bleak picture, the month-over-month increase was below consensus of 0.9% and some small signs of improvement can be found in the sector-level detail. Data in the coming months should show whether this was a product of month-to-month volatility or a larger sign of easing pressures."

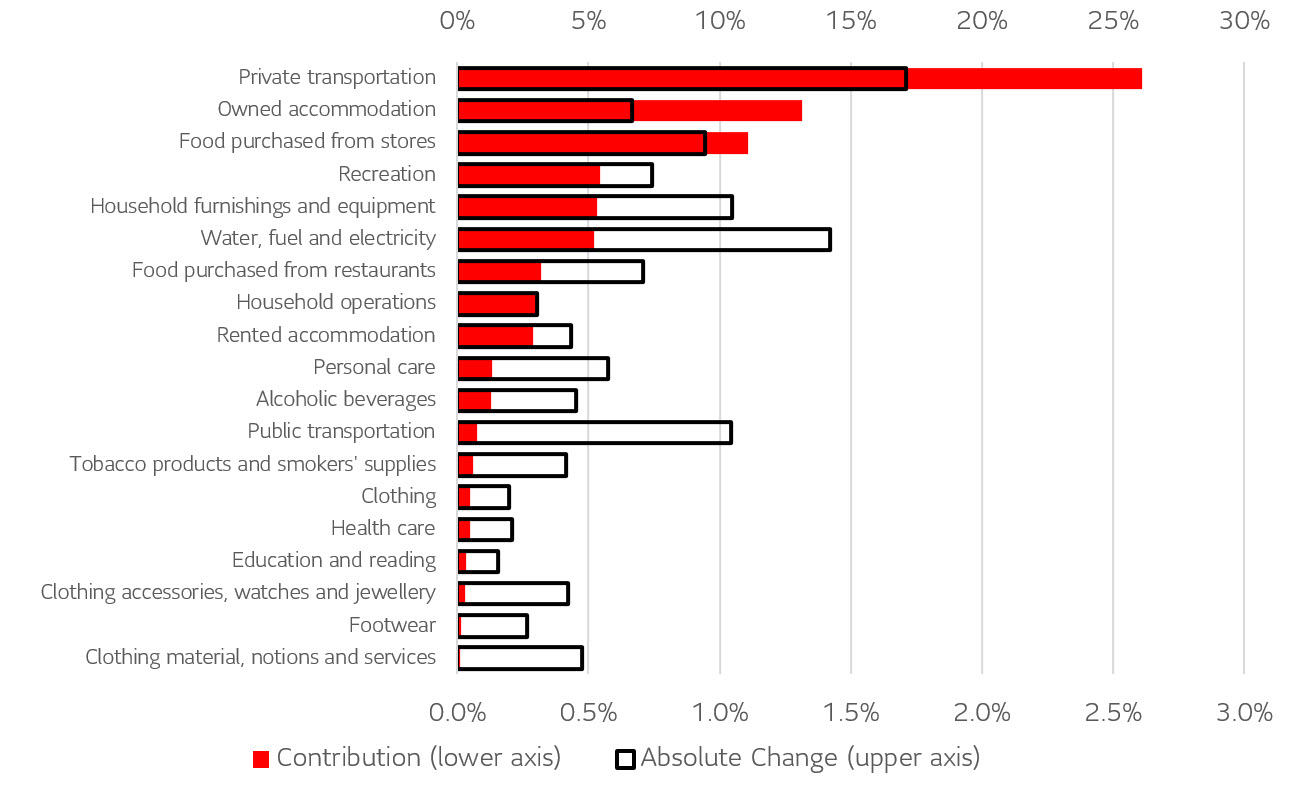

Private transportation accounts for 2.6% of the 8.1% year-over-year inflation (chart 2), driven by a 54.6% year-over-year increase in gasoline prices. We expect to see relief from energy prices in the July inflation print, given the significant drop in gas prices through first half of July.

Shelter costs account for 2.1% of the year-over-year reading, with owned accommodation as a large contributor. Signs of recovery can be seen in the month-over-month increase (+0.4%), which was the lowest since November 2021.

Food purchased from grocery stores accounts for 1.1% of year-over-year inflation. Food purchased from stores declined month-over-month for the first time since April of 2021. Food and energy will continue to be large contributors to year-over-year inflation, but could be volatile month-to-month.

While clothing prices experienced a 2% absolute increase year-over-year, on a month-over-month basis they fell for the first time since December 2021.

Chart 1: CPI Change

Chart 2: Canada headline CPI contribution year-over-year

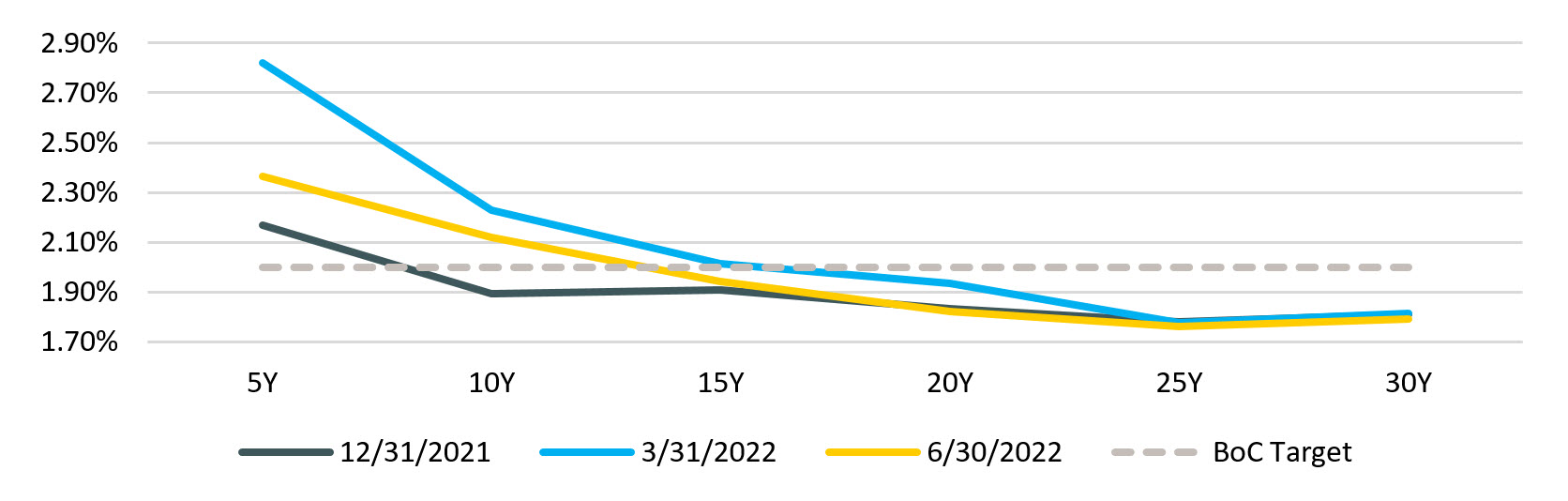

Steve’s take: “Breakeven levels have decreased in recent months, reflecting the market’s expectations that inflation will fall. As a result, real return bond (RRB) pricing appears attractive for those who wish to hedge against the risk of higher inflation persisting. The main downside risk of RRB pricing is a potential further decline in inflation expectations. This may occur if inflation is moderated by central banks more effectively than market expectations or due to a recession."

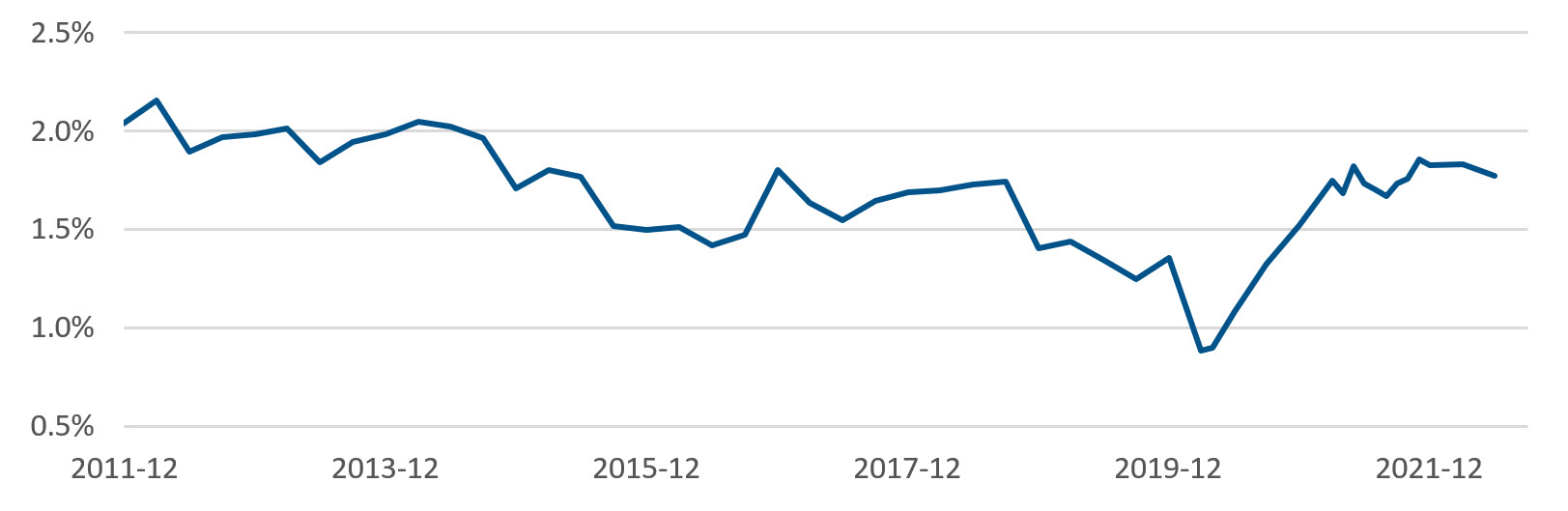

30 year break-even inflation rates ended Q2 2022 at 1.78% (chart 3), a slight decrease from Q1. This indicates that market expectations of long-term inflation remain anchored.

Short- and mid-term break-even inflation decreased over the quarter (chart 4). The decrease in break-even rates at these maturities indicates that markets expect inflation to fall, either due to effective moderation by the central bank or a recession.

Break-even inflation rates at the long end of the curve (25+ years) have remained stable, and below the Bank of Canada’s 2% inflation target. This suggests that a systemic shift to a higher-inflation regime is not expected by real return bond markets. Purchasing inflation protection remains attractive for investors who wish to protect themselves against such a scenario.

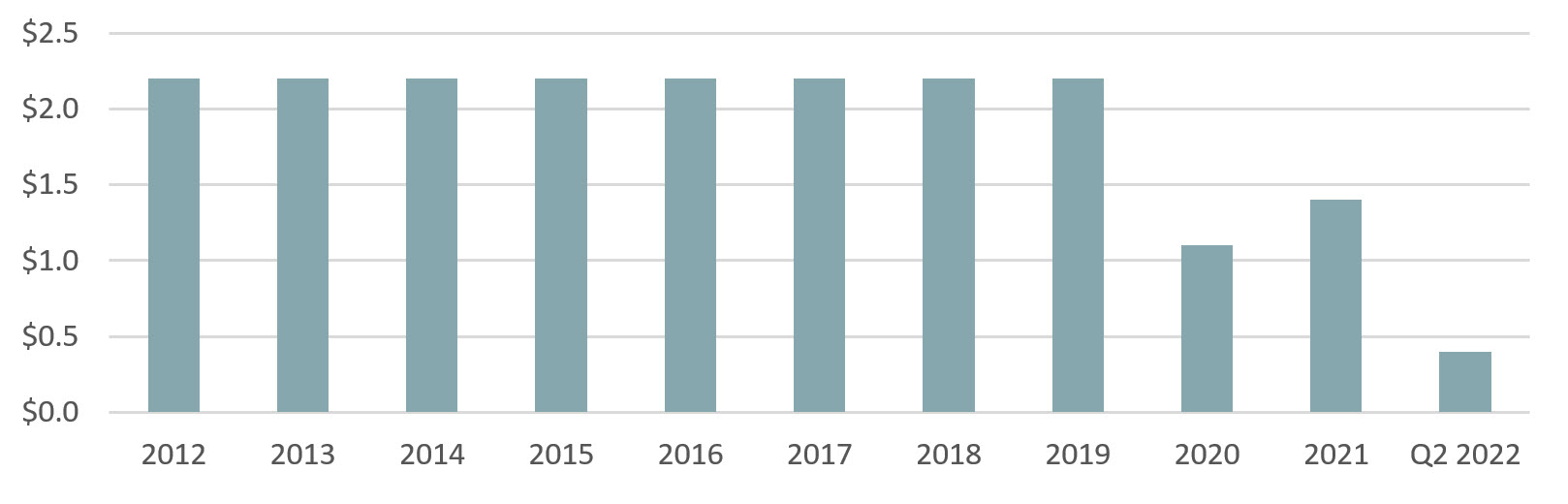

$0.4B of 2054 Federal RRBs were auctioned on May 26, 2022 (chart 5). The next Federal RRB auction is scheduled for September 1, 2022, with further information to be released by the Bank of Canada on August 25, 2022.

Chart 3: Long-term break-even inflation rate (%)

Chart 4: Break-even inflation curve (%)

Chart 5: Federal Real Return Bonds Auctioned ($B)

FOR MORE INFORMATION: SLC.info@sunlife.com

The content of this presentation is intended for institutional investors only. It is not for retail use or distribution to individual investors. All investments involve risk including the possible loss of capital. This presentation is for informational and educational purposes only. Past performance is not a guarantee of future results.

Unless otherwise stated, all figures and estimates provided have been sourced from the Bank of Canada. The information provided on liquidity is based on internal investment management experience. Unless otherwise noted, all references to “$” are in CAD. Any reference to a specific asset does not constitute a recommendation to buy, sell or hold or directly invest in it. It should not be assumed that the recommendations made in the future will be profitable or will equal the results of the assets discussed in this document.

The information contained in this presentation is not intended to provide specific financial, tax, investment, insurance, legal or accounting advice and should not be relied upon and does not constitute a specific offer to buy and/or sell securities, insurance or investment services. Investors should consult with their professional advisors before acting upon any information contained in this presentation.

Forward-looking statements are speculative in nature and may be subject to risks, uncertainties and assumptions and actual results which could differ significantly from the statements. Do not place undue reliance upon such forward-looking statements.

SLC Management is the brand name for the institutional asset management business of Sun Life Financial Inc. (“Sun Life”) under which Sun Life Capital Management (Canada) Inc. operates in Canada. More information are available at https://www.slcmanagement.com

CPI change (chart 1)

12-month, YTD, and MoM change in the Statistics Canada Consumer Price Index, monthly, not seasonally adjusted (Table 18-10-0004-01)

Canada headline CPI contribution year-over-year (chart 2)

Bank of Canada Consumer Price Index Portal

Long-term break-even inflation (chart 3)

Calculated as ((1 + Government of Canada benchmark bond yields, long term [CANSIM V39056]/2)/(1 + Real return benchmark bond yield, long term [CANSIM V39057]/2))^2 – 1.

Break-even inflation curve (%) (chart 4)

Sourced from Bloomberg

Federal Real Return Bonds auctioned ($B) (chart 5)

Bank of Canada Government Securities Auctions, Government of Canada Historical Auction Results, RRB Results

“FTSE®” is a trade mark of FTSE® International Limited and is used under license.

No part of this material may, without SLC Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

© SLC Management, 2022